Now that I’ve had a few months to settle into my new position as AMSAT Treasurer and spend a little time digging through the numbers, I thought it was time to share what I have found and set the record straight about some of the misinformation that is being spread about AMSAT’s financial position.

Despite rumors and misquotes of AMSAT being on an unsustainable path, let’s look at where we really are and how we are doing.

Financial Performance

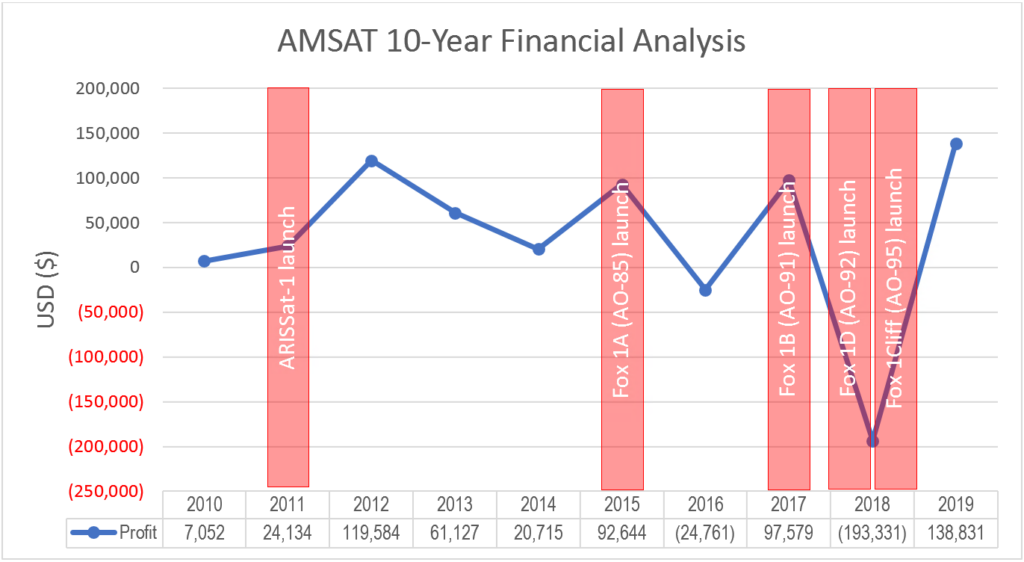

- Over the past ten years (2010-2019), AMSAT has averaged a $34,357 increase in net assets (what most people refer to as profits) per year.

- Our combined revenues over expenditures (profits) for the past 5 years (2015-2019) were $110,962, which includes launching 4 amateur satellites into space, readying RadFxSat-2 (Fox-1E) and the ARISS InterOperable Radio System for flight, and getting started on GOLF and Lunar Gateway projects.

- In 2019, AMSAT generated $756,256 in revenues with $617,425 in expenditures.

Note: Year to year fluctuations are generally a result of timing differences between project fundraising efforts and when AMSAT needs to spend money. In addition, AMSAT maintains its reserves in investment accounts, which are subject to market price fluctuations and must be included in our financial statements.

2018 is a perfect example:

-

- AMSAT authorized a $62,055 payment to NASA, which was not reimbursed until 2019.

- AMSAT spent $62,397 on the initial hardware development for GOLF.

- AMSAT launched two satellites in 2018, Fox-1D (AO-92) and Fox-1Cliff (AO-95).

- AMSAT had to report a $77,128 fair market value loss in investments (which was fully recovered in 2019).

Don’t get me wrong – there is certainly room for improvement. I have already identified and started to implement cost-saving and budgetary control measures that can and will make us more efficient. As AMSAT Treasurer, it is my job to safeguard AMSAT’s resources from both fraud and waste, and I intend to do exactly that. I look forward to what more we can achieve.

Membership

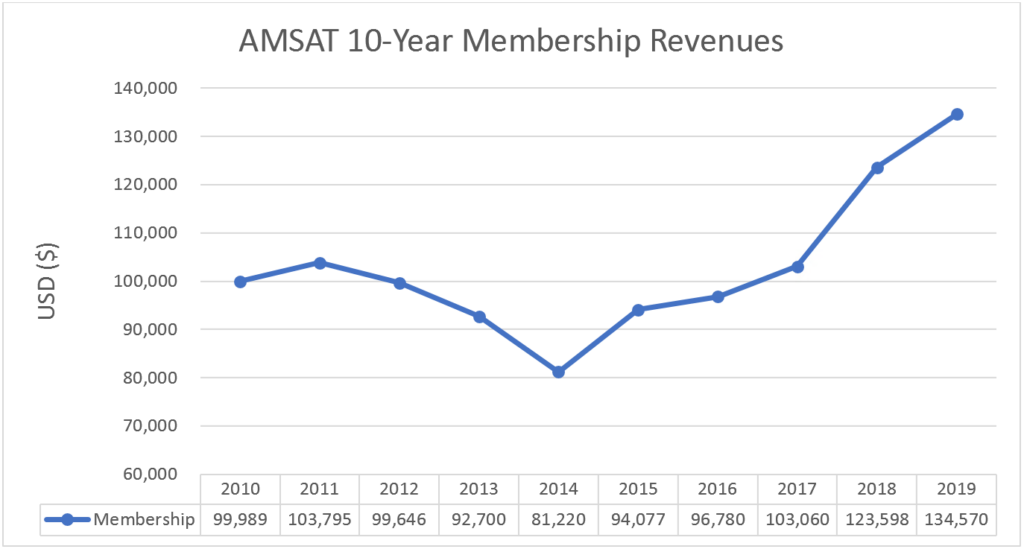

- Membership revenues continue to rise and have increased 65.68% in just that past 5 years, all without any increase in dues rates for our members.

- New memberships, renewals, life memberships, and AMSAT Store purchases for the first three months of 2020 are on track to exceed the same revenue sources for 2019.

Transparency

AMSAT is fully committed to financial transparency. Our financial statements and regulatory informational reports (Form 990s) are and have always been publicly available (www.amsat.org/audit-and-other-financial-reports/). Furthermore, to add confidence, an independent certified public accounting firm reviews our financial statements and includes their report with our financials.

Solvency

AMSAT is on a solid financial footing and headed in the right direction. We started this year with over $134,000 in cash and over $591,000 in investments. The level of our reserves, ability to generate more revenues than expenses, and ability to continue to grow our members has AMSAT fiscally positioned to accept whatever challenges and opportunities tomorrow brings.

Conclusion

AMSAT does not expect to fully fund itself with membership dues. Member dues are meant to cover member services and benefits. Funding for everything else must come from other sources.

In 2019, member dues accounted for only $134,570 of AMSAT’s total revenues. The remaining $621,686 came from the kind hearts of our donors and the incredible work of our volunteers – seeking out new revenue streams and securing grants to further support our mission.

We, at AMSAT, are keeping our promise to Keep Amateur Radio in Space and doing so in a fiscally responsible manner. To say otherwise is either a uniformed opinion or intentional misinformation – The Numbers Don’t Lie.

Robert Bankston (KE4AL), CPA

Treasurer

Radio Amateur Satellite Communication (AMSAT)

In addition to being a licensed amateur radio operator, Robert is a certified public accountant (CPA), business consultant, and principal with Bevis, Eberhart, Browning, Walker & Stewart, P.C., a public accounting firm in the Southeast United States. Robert serves in the lead corporate finance and accounting division, coordinating with area controllers, account managers, senior-level executives, investors, and lenders to provide business consulting, financial audit and review, and tax compliance services for midsize and multimillion-dollar companies and organizations.